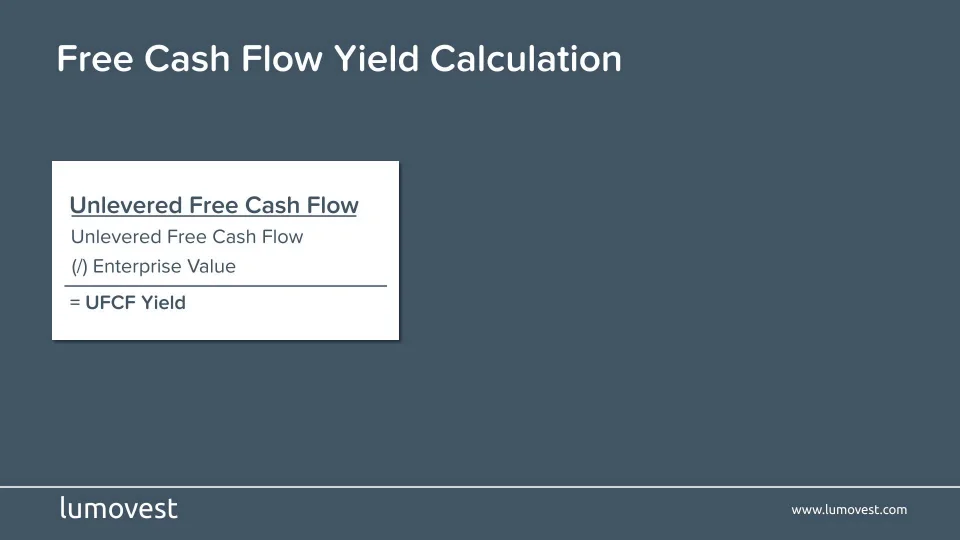

unlevered free cash flow enterprise value

If capital is raised via equity it is accounted for. It is the inverse of the Free Cash Flow Yield.

Enterprise Valuation Final Revised

Related to or available to all.

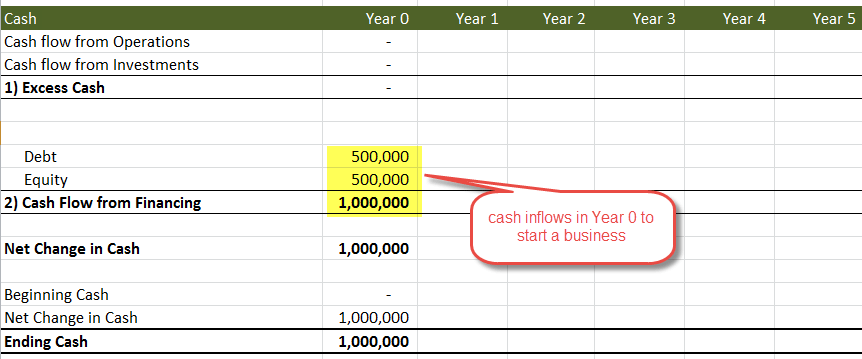

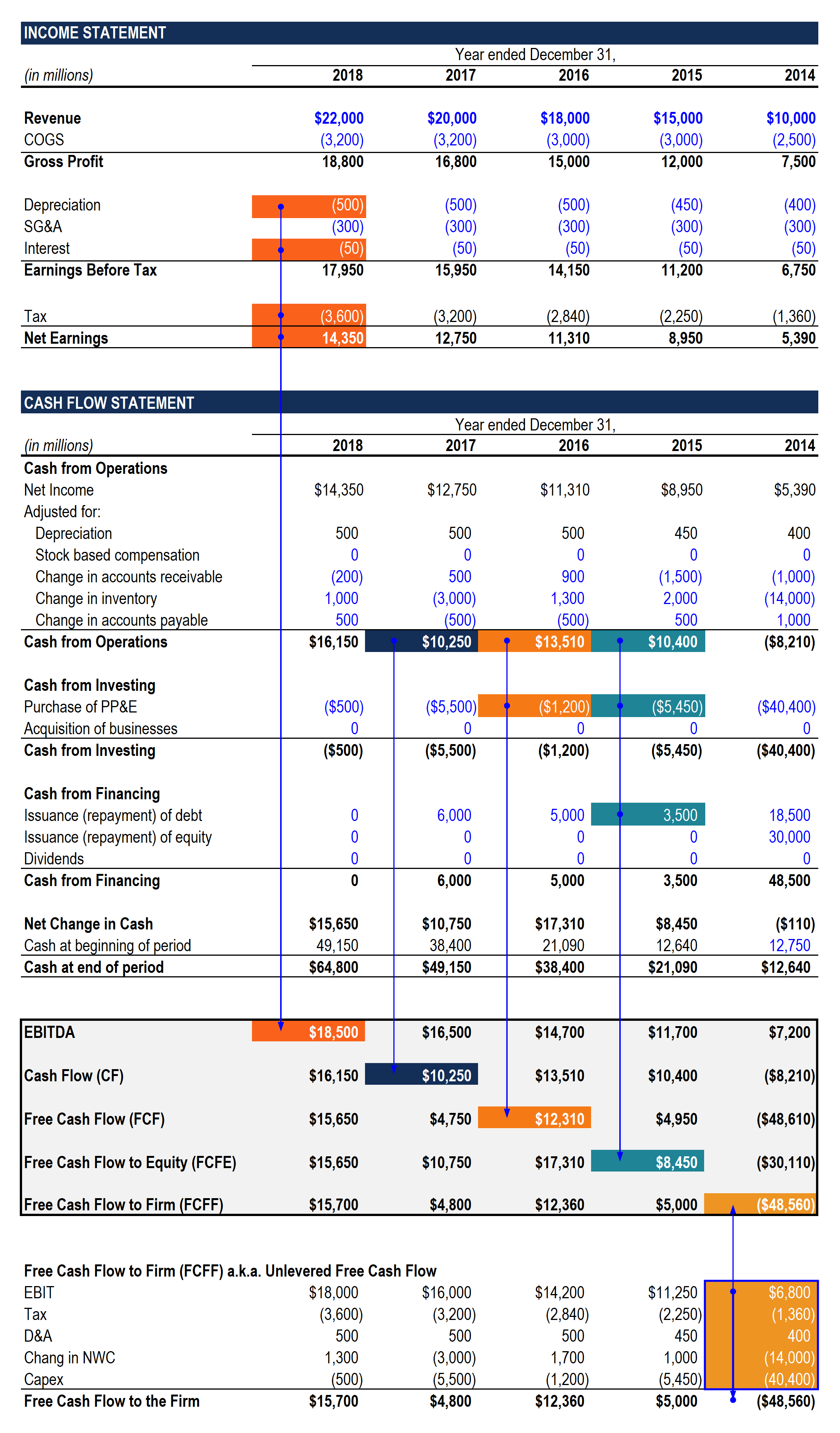

. It is technically the cash flow that equity holders and debt holders would have access to. Management is doing a bad job The firm must raise capital from the capital markets. Unlevered Free Cash Flow is used in financial modeling to determine the enterprise value of a firm.

How to calculate unlevered free cash flow When calculating UFCF you consider EBITDA. Get the tools used by smart 2. ZI a global leader in modern.

View Comstock Incs Unlevered Free Cash Flow Yield trends charts and more. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Axons latest twelve months unlevered free cash flow is -2323 million.

View Axon Enterprise Incs Unlevered Free Cash Flow trends charts and more. Like levered cash flows you can find unlevered cash flows on the balance sheet. Unlevered Free Cash Flow also known as UFCF or Free Cash Flow to Firm FCFF is a measure of a companys cash flow that includes only items that are.

Enterprise Value to Free Cash Flow compares the total valuation of the company with its ability to generate cashflow. Another way to calculate free cash flow yield is to use enterprise value as the divisor. Unlike levered free cash flow or free cash flow to equity FCFE the UFCF metric is unlevered which means that the companys debt burden is not taken into account.

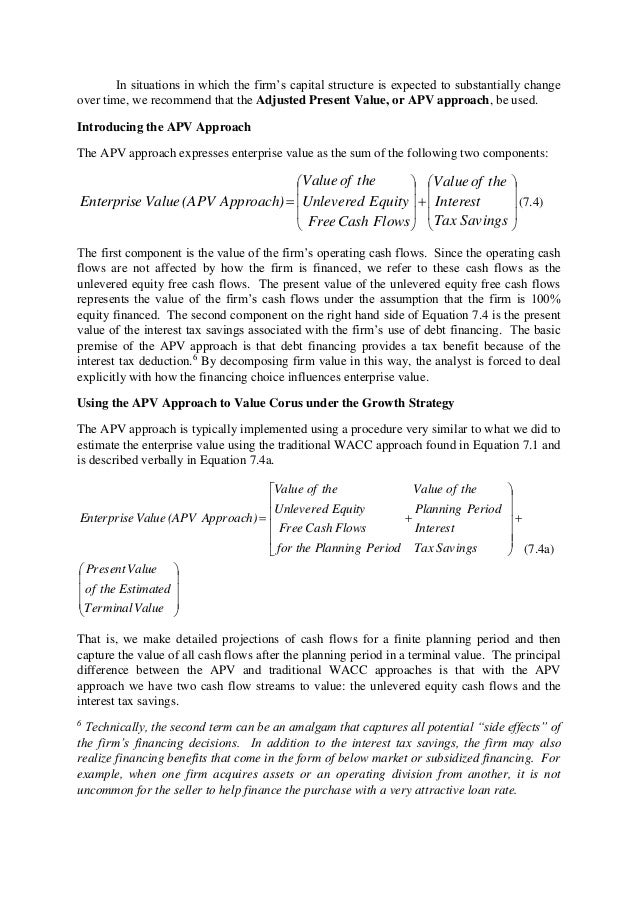

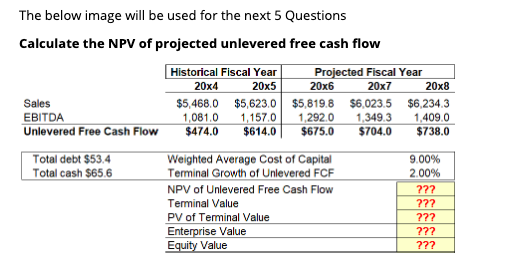

When using unlevered free cash flow to determine the Enterprise Value EV Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to. View Axon Enterprise Incs. To many enterprise value is a more accurate measure of the value of a firm as it.

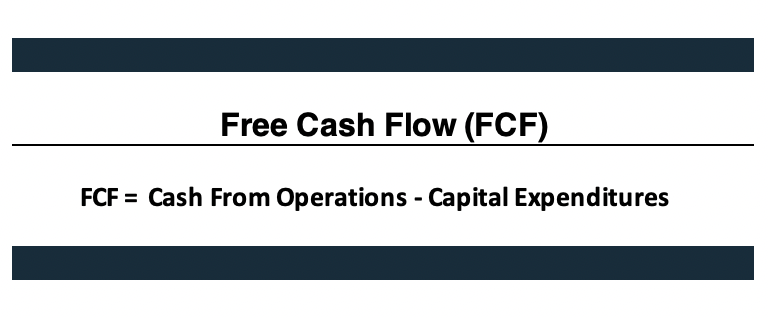

The average consumer may not ever see or need to know this. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt. UFCF EBITDA - CapEx - Changes in WC - Taxes where UFCF Unlevered free cash flow EBITDA Earnings.

The lower the ratio of. Arriving at Equity Value. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital.

What does a negative value for unlevered free cash flow imply for the claimants of a firm. Unlevered Free Cash Flow UFCF Formula The formula to calculate UFCF is. A business or asset that generates more cash than it invests.

Unlevered free cash flow formula UFCF EBITDA - Capital expenditures CAPEX -. Unlevered Free Cash Flow is used in financial modeling to determine the enterprise value of a firm. EV is unlevered because it does not depend on the capital structure of the firm.

Cash Flow from Operations of 857 million and Unlevered Free Cash Flow of 998 million Vancouver WA November 1 2022 - ZoomInfo NASDAQ. It is technically the cash flow that equity holders and debt holders would have access to. Comstocks latest twelve months unlevered free cash flow yield is 317.

In financial modeling it is common practice to model Free Cash Flow to Firm which is based on the cash flow derived from 100 ownership of all assets and therefore. Whereas levered free cash flows can provide an accurate look at a companys financial health. If it is raised via debt it is accounted for.

Unlevered free cash flow UFCF is used at a high level to determine the enterprise value of a business.

Free Cash Flow Explanation Definition Calculation Speck Company

Enterprise Value Vs Equity Value Vkontakte

Fcff Calculate Free Cash Flow To Firm Formulas Examples

Dcf And Pensions Enterprise Or Equity Cash Flow The Footnotes Analyst

Enterprise Value Vs Equity Value Eqvista

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

When Should I Use Unlevered Vs Levered Free Cash Flows In A Valuation Quora

Fcff Vs Fcfe Top 5 Useful Differences With Infographics

Fcff Calculate Free Cash Flow To Firm Formulas Examples

Solved Calculate Terminal Value Calculate The Pv Of The Chegg Com

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

Understanding The Differences Between Levered And Unlevered Free Cash Flow Article

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

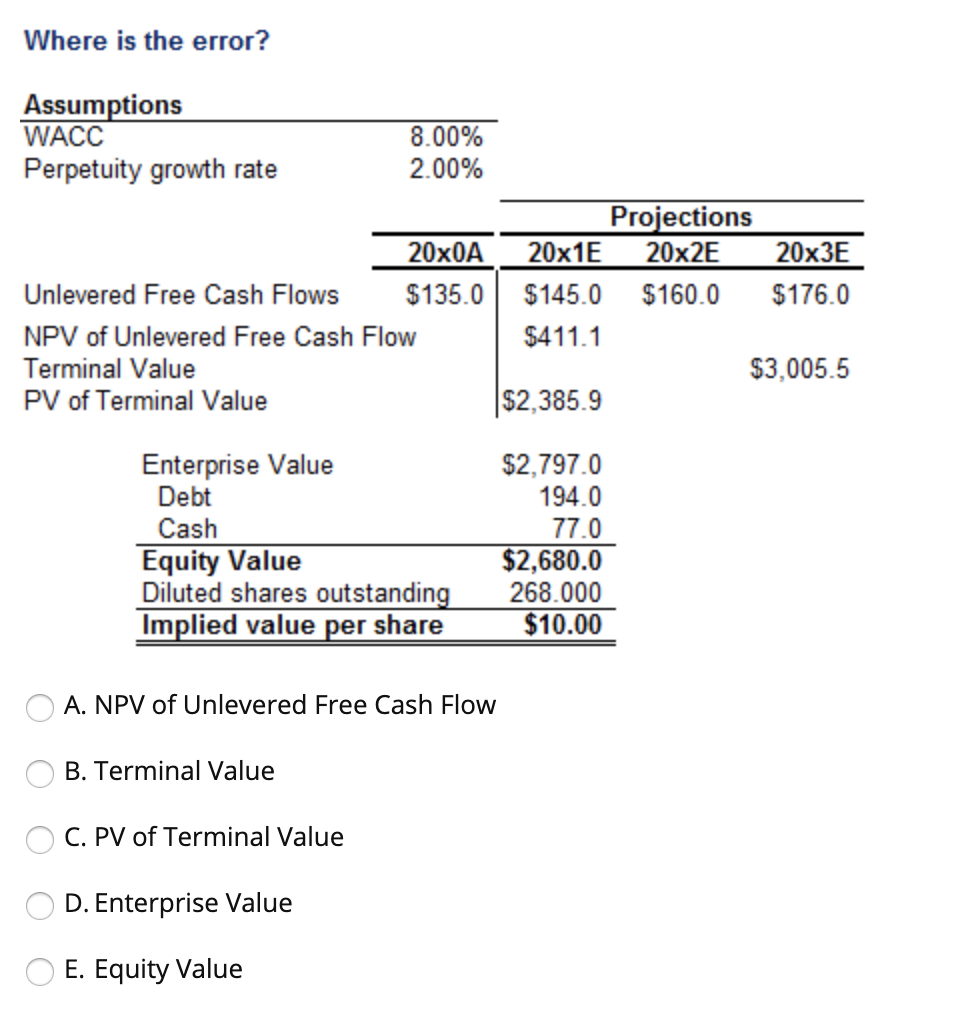

Solved Where Is The Error Assumptions Wacc Perpetuity Chegg Com